Mark Hulbert: Santa Claus gives you attractive odds of a stock market rally

Just like the real Santa Claus, the Santa Claus rally doesn’t arrive until Christmas.

That hasn’t kept Wall Street from attributing every upward blip to Saint Nick over the past six weeks. I worry that his name has been taken in vain more times than You Know Who.

But the only December period in which the stock market has above-average odds of rising begins after Christmas.

I base this conclusion on the average gain in the Dow Jones Industrial Average DJIA, +0.55% starting the first trading session after Christmas and continuing through the second trading session of the New Year. In most years, that period encompasses six trading sessions. (In defining the Santa Claus rally this way, I am following the lead of the Stock Traders Almanac.)

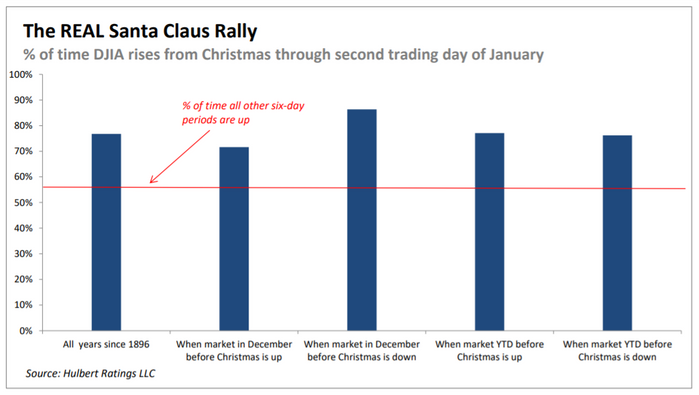

As you can see from the accompanying chart (above), the DJIA since its creation in 1896 has risen 77% of the time during this Santa Claus rally period. The odds of rising across all other six-day periods in the calendar are 56%. The difference between 56% and 77% is statistically significant at the 95% confidence level that statisticians often use when determining if a pattern is genuine.

Furthermore, as you can see from the chart, there is impressive consistency to this post-Christmas rally. It doesn’t matter if stocks rise in December (before Christmas) or since the start of any given year.

The DJIA’s average gain during this period is also noteworthy. Taking into account all years since 1896, including those few in which there was no Santa Claus rally, the Dow has risen an average of 1.49% after Christmas through the second trading day of January. That compares to an average gain of 0.16% across all other six-day periods in the calendar.

Why Santa Claus visits only after Christmas

You nevertheless shouldn’t bet on a seasonal pattern such as the Santa Claus rally unless there are sound theoretical reasons for why it should exist. Mere statistical significance is a necessary, but not sufficient, condition to justify making a trade.

Such a theoretical justification appears to exist in the case of the Santa Claus rally, however. The period after Christmas represents the confluence of three separate patterns that independently have been documented by researchers:

- The “turn-of-the-month” effect, in which the stock market tends to perform better over the last couple days of each month and the first couple days of the subsequent month.

- The “turn-of-the-year” effect, which is similar to the turn-of-the-month effect.

- The “pre-holiday” effect, in which the stock market tends to perform well prior to stock exchange holidays.

Bear in mind, however, that even with statistics and theory on its side, the Santa Claus rally doesn’t amount to a guarantee. Even if the future is like the past, there’s still a 23% chance that the stock market won’t perform well in the period after Christmas. Only you can decide whether these odds justify a year-end bet.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.

Comments are closed.